Wealthsimple 'Invest' vs 'Trade' - review & thoughts

My ideas and thoughts are not financial advice. Experiences based on USD and CAD stocks.

"My wealth has come from a combination of living in America, some lucky genes, and compound interest." - Warren Buffett.

"My wealth has come from a combination of living in America, some lucky genes, and compound interest." - Warren Buffett.

"Compound interest is the eighth wonder of the world. He who understands it, earns it ... he who doesn't, pays it." - Albert Einstein.

With the recent COVID lockdowns and introduction of new do-it-yourself investing platforms, there's been an influx of retail investors. As someone who recently started investing, I've been curious about $0 commission fee platforms and in this article today I review Wealthsimple's 'Invest' type account. Here are some thoughts that might give you some ideas for your implementation.

Before I dive further, here's some terminology that will help you understand my notes better:

- Dividend: A dividend is a corporation's distribution of profits to its shareholders. In layman's terms, think of it as a cashback incentive that you get for essentially owning the stock.

- Robo-advisor: A digital platform that allows auto-pilot investing. It invests money in broad portions of the stock market.

- DRIP: Dividend Re-Investment Program.

- Bull market: When the market trends higher, thus creating higher highs and higher lows.

- Bear market: When the market trends lower, thus creating lower highs and lower lows.

- Day Trading: Buying a stock at a lower price and selling it the same day for a profit, mostly driven by real-time news.

- Swing Trading: Buying a stock at a lower price and selling it once it reaches a certain higher expected level. This could take a couple of days, weeks, or even months. Usually helpful when expecting any major upcoming collaborations, positive news, or increase in profits.

How does DRIP work?

Any time a particular stock pays out a dividend, the payout amount (assuming it covers the cost of one full share) is used towards buying more of that specific stock, generally at a slightly lower/discounted rate than the market price, without an additional commission fee!

Any time a particular stock pays out a dividend, the payout amount (assuming it covers the cost of one full share) is used towards buying more of that specific stock, generally at a slightly lower/discounted rate than the market price, without an additional commission fee!

This method is most useful for long term investors and works best when you can set money aside that you won't have to touch for years to come. It's essentially a retirement plan.

Who/What is Wealthsimple?

Wealthsimple is a Canadian online investment management service founded in September 2014. The company manages assets worth 8.4 billion CAD and employs about 235 employees. 'Power Corporation' indirectly owns Wealthsimple via its 83.2% investments.Wealthsimple Trade vs. Invest

The company offers two ways to invest and subsequently two iOS/Android apps - Trade and Invest. Both types let you create three different types of accounts - Personal, RRSP, and TFSA.- Trade: This is a self-service account wherein you invest and manage your portfolio, just like any other broker. It's important to remember this is not meant for day traders. If you buy and sell the stock on the same day, your account is locked out for a short time. The idea behind this setup is to invest in long-term holds or trade like a swing-trader.

- Invest: This account leverages the power of robo-advisors wherein you setup a profile based on the risk you're willing to take and how many years later you would need the money. Based on your choices, 'Invest' purchases a percentage of equities and 'Fixed Income & Gold'.

My experience with Wealthsimple 'Invest'

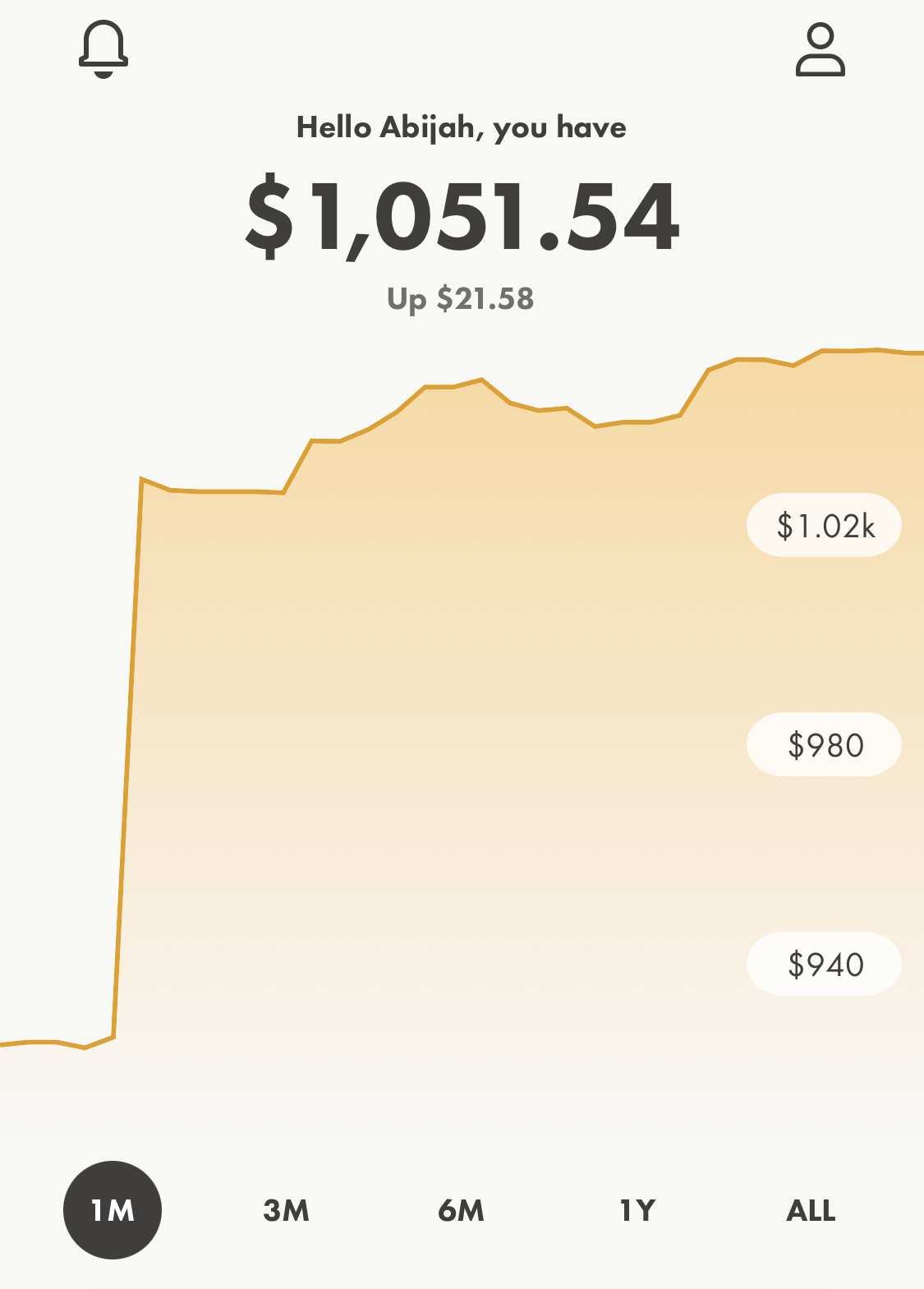

- I downloaded the Invest app in December 2020 and invested an amount of $1000 CAD. Since then, the portfolio is on auto-pilot. The screenshot is as of January 2021.

- It automatically invests any dividends to re-buy fractional shares in ETFs and bonds. In a month, I've received a total of $3.33 in dividends.

- I've setup an auto-deposit for each month to leverage the power of compound investing. Read more about that here.

- This account also lets you track your VISA/Debit card spending and roundup your purchases to the nearest dollar. This 'spare change' (if above $5) is automatically deposited into your account every week.

Portfolio breakdown

The percentage allocated to these will change based on your risk preferences in your profile.

The percentage allocated to these will change based on your risk preferences in your profile.

- Equities: XEF, EEMV, VTI, ACWV, XIC, VUS

- Fixed Income & Gold: ZFL, XSH, GLDM

Key takeaways

- I like to think of this account as a Savings account with a much better interest rate. It's more of a set-it-and-forget-it type where I know I will be automatically investing a small amount every month and leverage the power of compound investing.

- There's an annual fee of 0.5% based on your account size.

- If you found this article helpful, please use my referral link to signup for your account. It won't cost you anything extra!